The First Home Savings Account (“FHSA”) is a new registered plan that enables prospective first-time home buyers with the ability to contribute up to $40,000 toward saving for their first home on a tax-free basis. Similar to a Registered Retirment Savings Plan (“RRSP”), contributions to a FHSA are tax-deductible, and withdrawals to purchase a first home – including from investment income – are non-taxable, similar to a Tax-Free Savings Account (“TFSA”).

First proposed in the 2022 Federal Budget, legislation introducing the FHSA received Royal Assent in late 2022, formally enacting it into law. This article provides details about the First Home Savings Account and lists helpful planning tips for your consideration.

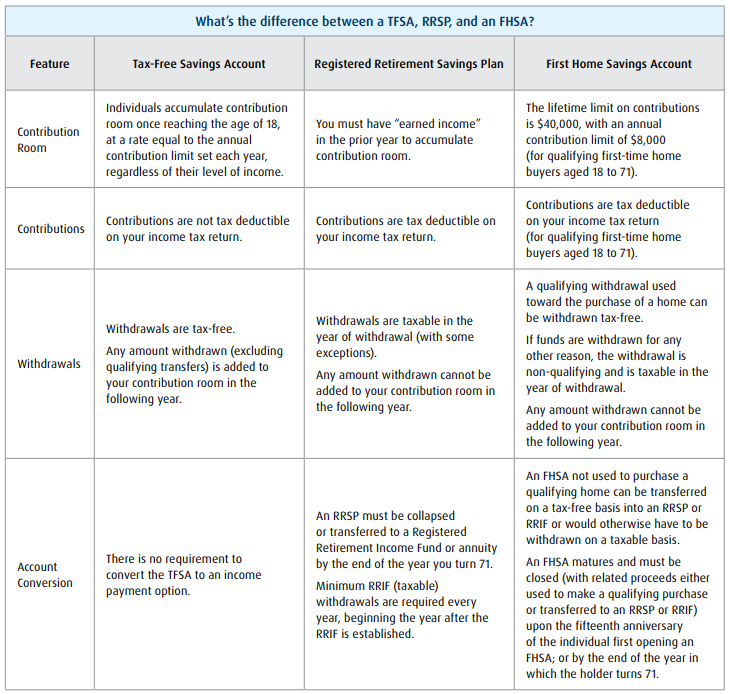

Features of the FHSA

Opening and closing accounts

To open an FHSA, an individual must be a resident of Canada and at least 18 years of age. They must also be a first-time home buyer, meaning that they have not lived in a home that was owned, either solely or jointly, with their spouse or common-law partner at any time in the calendar year before the account is opened, or at any time in the preceding four calendar years.

An FHSA matures and must be closed (with related proceeds either used to make a qualifying purchase, transferred tax-free to an RRSP or Registered Retirement Income Fund “RRIF” or withdrawn on a taxable basis) upon the fifteenth anniversary of the individual first opening an FHSA; or by the end of the year in which the holder turns 71.

Qualified investments

An FHSA is permitted to hold the same qualified investments that are currently allowed for TFSAs. Taxpayers are able to hold a broad range of investments, including mutual funds, publicly-traded securities, government and corporate bonds, and guaranteed investment certificates (“GICs”).

The prohibited investment rules and non-qualified investment rules applicable to other registered plans also apply to FHSAs, including the potential tax consequences described in this article. These rules are intended to disallow investments in entities with which the account holder does not deal at arms length, as well as investments in certain assets such as land, shares of private corporations and general partnership units.

Eligible contributions

The lifetime limit on contributions is $40,000, with an annual contribution limit of $8,000. Meaning, individuals are subject to contributing the lesser of their annual limit and remaining lifetime limit.

The annual contribution limit applies to contributions made in a particular calendar year. Individuals are able to claim an income tax deduction for contributions made in a particular taxation year. Unlike RRSPs, contributions made within the first 60 days of a given calendar year cannot be attributed to the previous tax year.

An individual is allowed to carry forward unused portions of their annual contribution limit up to a maximum of $8,000. Therefore, an individual contributing less than $8,000 in a given year can contribute the unused amount (i.e., $8,000 less their contribution in that year) in a subsequent year, on top of their annual contribution limit of $8,000, subject to the lifetime contribution limit. For example, an individual contributing $5,000 to a FHSA in 2023, is allowed to contribute $11,000 in 2024 (i.e., $8,000 plus the remaining $3,000 from 2023). However, amounts carried forward only start accumulating after an individual opens an FHSA for the first time.

An individual is permitted to hold more than one FHSA, however, the total amount an individual contributes to all of their FHSAs cannot exceed their annual and lifetime contribution limit of $40,000. Taxpayers are responsible for ensuring they do not exceed their annual limit. The Canada Revenue Agency (“CRA”) intends to provide basic FHSA information to support taxpayers in determining how much they can contribute in a given year.

Contributions made to an FHSA following a qualifying withdrawal toward the purchase of a first home are not deductible from income for tax purposes.

Undeducted contributions

An individual is not required to claim a deduction from income for the tax year in which a contribution is made. Like RRSP deductions, contributed amounts can be carried forward indefinitely and deducted in later tax years (e.g., if you expect to be in a higher tax bracket in the future).

Taxation of the FHSA

Any income, losses, and gains in respect of investments held within an FHSA, as well as qualifying withdrawals, would not be included (or deducted) in computing income for tax purposes or taken into account in determining eligibility for income-tested benefits or credits delivered through the income tax system (for example, the Canada Child Benefit and the Goods and Services Tax Credit).

Qualifying withdrawals

In order for an FHSA withdrawal to be a qualifying (i.e., non-taxable) withdrawal, certain conditions must be met:

-

A taxpayer must be a first-time home buyer at the time a withdrawal is made. Specifically, the taxpayer cannot have lived in a home that they or their spouse or common-law partner, either solely or jointly owned with others, at any time during the part of the calendar year before the withdrawal is made or at any time in the preceding four calendar years. There is an exception to allow individuals to make qualifying withdrawals within 30 days of moving into their first home.

-

The taxpayer must also have a written agreement to buy or build a qualifying home before October 1 of the year following the year of withdrawal, and intend to occupy the qualifying home as their principal place of residence within one year after buying or building it.

-

A qualifying home is a housing unit located in Canada. A share in a co-operative housing corporation that entitles the taxpayer to possess and have an equity interest in a housing unit located in Canada, would also qualify. However, a share that only provides a right to tenancy in the housing unit would not qualify.

Provided the taxpayer meets the qualifying withdrawal conditions, the entire amount of available FHSA funds may be withdrawn on a tax-free basis in a single withdrawal or a series of withdrawals.

Non-qualifying withdrawals

Withdrawals that are not qualifying withdrawals are included in the income of the individual making the withdrawal for income tax purposes. Financial institutions are required to collect and remit withholding tax on non-qualifying withdrawals, consistent with the treatment applicable to taxable RRSP withdrawals.

Non-qualifying withdrawals do not re-instate either the annual contribution limit or the lifetime contribution limit.

Transfers to and from an FHSA

An individual may transfer funds from an FHSA to another FHSA, an RRSP or a RRIF on a tax-free basis.

Funds transferred to an RRSP or RRIF are subject to the usual rules applicable to these accounts, including taxability upon withdrawal. These transfers would not reduce, or be limited by, an individual’s available RRSP contribution room. These transfers do not reinstate an individual’s FHSA lifetime contribution limit.

Individuals are also allowed to transfer funds from an RRSP to an FHSA on a tax-free basis, subject to the FHSA annual and lifetime contribution limits and the qualified investment rules. Although such transfers are subject to FHSA contribution limits, they are not deductible from income and do not reinstate an individual’s RRSP contribution room.

Interaction with the Home Buyers’ Plan (“HBP”)

The HBP continues to be available as under existing rules. An individual is permitted to make both an FHSA withdrawal and an HBP withdrawal in respect of the same qualifying home purchase.

Spousal contributions and attribution rules

The FHSA holder is the only taxpayer permitted to claim deductions for contributions made to their FHSA. Individuals are not able to contribute to their spouse or common-law partner’s FHSA and claim a deduction. An individual can contribute to their FHSA from funds provided to them by their spouse.

Normally, if an individual transfers property to the individual’s spouse or common-law partner, the income tax rules generally treat any income earned on that property as income of the individual. An exception to these “attribution rules” will allow individuals to take advantage of the FHSA contribution room available to them using funds provided by their spouse. Specifically, these attribution rules will not apply to income earned in an FHSA that is derived from such contributions. Similarly, no attribution of income earned within an FHSA will arise if a parent gifts funds to an adult child to contribute to their own FHSA.

Marital breakdowns

On the breakdown of a marriage or a common-law partnership, an amount may be transferred directly from the FHSA of one party in the relationship to an FHSA, RRSP, or RRIF of the other. In such circumstances, transfers will not re-instate any contribution room of the transferor and will not be counted against any contribution room of the transferee.

Over-contribution, non-qualified investment, prohibited investment, and advantage taxes

Like TFSAs, a one percent tax on over-contributions to an FHSA applies for each month (or a part of a month) to the highest amount of excess that exists in that month.

When a taxpayer’s annual contribution limit is reset at the beginning of each calendar year, over-contributions from a previous year may cease to be an over-contribution. A taxpayer is allowed to deduct an over-contributed amount for a given year in the tax year in which it ceases to be an over-contribution, but not earlier. However, if a qualifying withdrawal is made before an over-contribution ceases to be an over-contribution, no deduction would be provided for the over-contributed amount.

Example:

Alyssa contributes $10,000 on November 15, 2023, and does not make a withdrawal. This contribution exceeds Alyssa’s annual FHSA contribution limit by $2,000.

Alyssa is subject to an over-contribution tax of $40 (1% × $2,000 × 2 months) when filing her 2023 tax return in 2024. The $2,000 amount would cease to be an over-contribution on January 1, 2024, as a new annual limit of $8,000 is available.

Alyssa will be allowed to deduct $8,000 from her 2023 net income. Presuming Alyssa did not make a qualifying withdrawal between November 15, 2023, and January 1, 2024, a deduction of the additional $2,000 from Alyssa’s 2024 net income would be allowed.

The Income Tax Act imposes other taxes in certain circumstances involving non-qualified investments, prohibited investments, and unintended advantages in respect of other registered plans. These rules also apply to the FHSA.

The Minister of National Revenue has authority to cancel or waive all or a part of these taxes in appropriate circumstances. Various factors are considered, including: reasonable error; the extent to which the transactions that gave rise to the tax also give rise to another tax; and the extent to which payments were made from the taxpayer’s registered plan.

Treatment upon death

Like TFSAs, individuals are permitted to designate their spouse or common-law partner as a successor account holder, in which case the account can maintain its tax-exempt status. If named as the successor holder, the surviving spouse becomes the new holder of the FHSA immediately upon the death of the original holder provided the surviving spouse meets the eligibility criteria to open an FHSA (see the discussion under “Opening and Closing Accounts”). Inheriting a FHSA in this way does not impact the surviving spouse’s contribution limits. Inherited FHSAs assume the surviving spouse’s closure deadlines. If the surviving spouse is not eligible to open a FHSA, amounts in the FHSA could instead be transferred to a RRSP or RRIF of the surviving spouse, or withdrawn on a taxable basis.

If the beneficiary of an FHSA is not the deceased account holder’s spouse or common-law partner, the funds need to be withdrawn and paid to the beneficiary. Amounts paid to the beneficiary from an FHSA are included in the income of the beneficiary for tax purposes, in contrast to the treatment of amounts paid to a designated RRSP or RRIF beneficiary on the death of the annuitant. When such payments are made the payment to the beneficiary will be subject to withholding tax.

Non-residents

Taxpayers are allowed to contribute to their existing FHSAs after emigrating from Canada, but they are not able to make a qualifying withdrawal as a non-resident. Specifically, a taxpayer withdrawing funds from an FHSA must be a resident of Canada at the time of withdrawal and until the time a qualifying home is bought or built. Withdrawals by non-residents are subject to a withholding tax.

Interest deductibility

Like RRSPs and TFSAs, interest on money borrowed to invest in an FHSA is not deductible in computing income for tax purposes.

Collateralization

Taxpayers must include, in income, the full value of any assets held within an FHSA and pledged as collateral for a loan.

Bankruptcy

FHSAs are not afforded creditor protection under the Bankruptcy and Insolvency Act.

Planning considerations

-

The FHSA carry-forward amounts will only start accumulating after an individual opens an FHSA for the first time. Accordingly, you may wish to open an FHSA earlier than you plan to contribute, in order to access carry-forward amounts and achieve a higher contribution limit. However, be mindful that an FHSA has a limited lifetime (up to 15 years, and only until age 71).

-

If you are eligible to open an FHSA and are likely to purchase a qualifying home within the 15-year timeframe - and by age 71 – but have limited funds, contributing now to your FHSA (instead of your RRSP) offers the advantage of allowing the investment growth within your FHSA to be used to fund your home purchase, versus the alternative of transferring up to $40,000 (maximum) from your RRSP to an FHSA in advance of a home purchase. This strategy of contributing to an FHSA will also not impact your RRSP contribution room, which will remain available for future contributions.

-

However, you can transfer your FHSA assets to your RRSP (or RRIF) on a tax-free basis, without impacting your RRSP contribution room, which provides flexibility if you have not used your FHSA assets to purchase a home within its 15-year lifetime (or age 71 restriction), thereby providing an additional boost to your RRSP savings.

-

If you are not eligible to open an FHSA but have an adult child (18 years of age or older), who is eligible to open an FHSA, and you would like to assist your child with their first home purchase, consider gifting your child funds to contribute to their FHSA account to help them save for their qualifying first home purchase.

-

As noted previously, similar to RRSP contributions, you are not required to claim a deduction for the tax year in which an FHSA contribution is made, therefore, you may wish to defer your FHSA deduction until you are in a higher tax bracket in order to receive higher tax savings.

-

You can only claim an income tax deduction for FHSA contributions made in a particular calendar year; it will therefore be important to make (or consider) any FHSA contributions before the end of each calendar year (December 31) to be able to claim a deduction for that calendar year. Unlike RRSPs, FHSA contributions made within the first 60 days of a given calendar year cannot be attributed to the previous tax year.

-

The types of investments eligible for an FHSA are very similar to those investments eligible to be held within an RRSP or TFSA. However, because of the limited lifetime and very specific purpose of an FHSA, it will be important to consider your time frame for purchasing a qualifying home as this may impact the types of investments you choose to hold in your FHSA. Similar to an RESP, where your asset allocation may shift over time as your child approaches post-secondary school (e.g., from a growth focus while your child is young, to a more conservative approach focussing on preservation and liquidity as your child ages), it will be important to consider the expected timing of your housing purchase in determining your investment horizon and asset allocation within your FHSA.

Seek advice

If you meet the requirements, you may benefit from the ability to use the tax-free FHSA to save for your first house.

For more information, please speak with your BMO financial professional.