You have to give it to Donald Trump and the Republican Party. Based on voting results so far, they have vastly outperformed relatively low expectations, especially in southern states, and could be on their way to once again defying opinion polls and predictive markets. However, this is far from a forgone conclusion. U.S. voters and indeed the world will likely have to wait several days for mail-in ballots to be counted in critical swing states (particularly Pennsylvania, Wisconsin and Michigan) before the next President is declared.

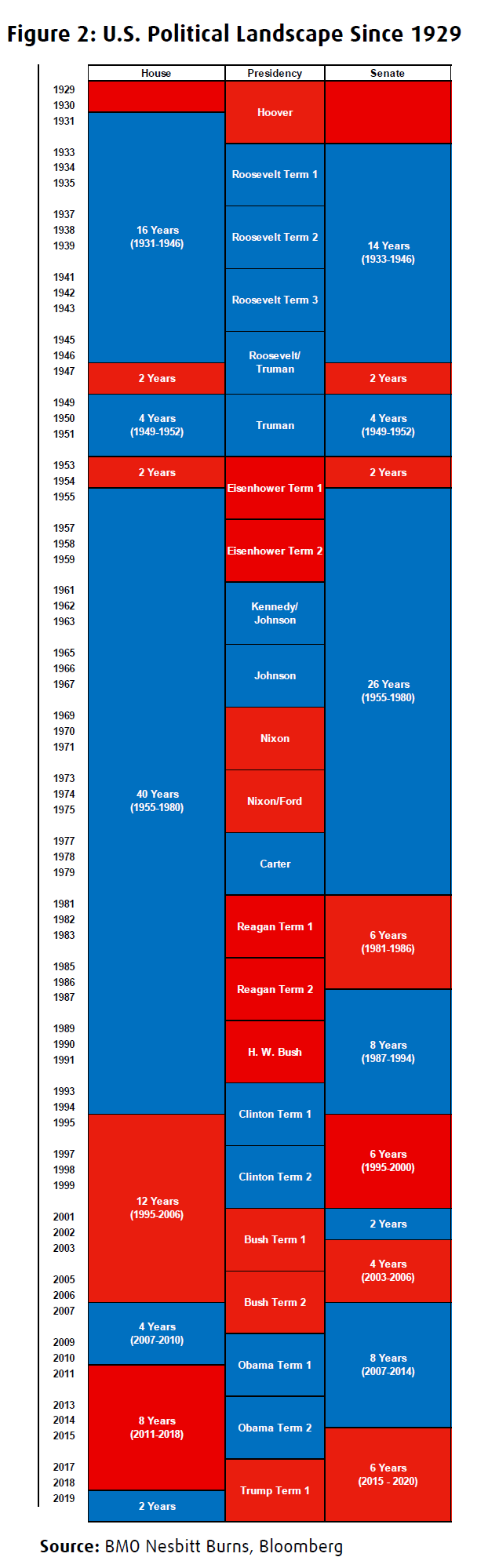

Despite the unclear outcome, the central narrative has certainly changed overnight; from a potential “Blue Wave” to a plausible status quo outcome where Republicans retain the Presidency and control of the Senate. This latter point is critical. This is because, while some proposals can be initiated by executive order, many, if not most, require congressional approval. Typically, an administration has the best chance of legislative success when the President’s party holds a majority in both the Senate and House of Representatives.

While the market tends to have a strong aversion to uncertainty, in this case investors may take comfort from the status quo, where tax policy would not involve significant changes if Republicans prevail. This scenario

would also forestall stated Democrat objectives to increase the minimum wage and strengthen environmental, financial and other regulations among several other proposals.

Fundamental backdrop favours equities

Regardless of the outcome of an election, often campaign promises become merely just that; promises that become diluted once the election is won. Certainly, political headlines will affect the ebb and flow of daily stock action, particularly for more politically sensitive sectors such as Health Care, Infrastructure, Energy and Defense. Policy aside, over fifty years of data has shown that environments with expansionary monetary policy, strong fiscal spending and positive economic momentum have been associated with favourable stock market returns. We believe that the current backdrop will be fundamentally supportive for equities, which also compare favourably to bonds given the low interest rate environment. The relative value of stocks (roughly a 3% dividend yield) compares with a less than one percent yield on 10-year Government bonds.

Tax policy no longer the headwind

Under the “Blue Wave” scenario, investors had some concern around the potential for increased corporate and personal taxes should Democrats prevail. The reduction of the corporate tax rate from 35% to 21% was one of the Trump administration’s largest achievements and resulted in a boost to the U.S. economy and job creation. Joe Biden campaigned on a higher corporate tax rate of 28%, a substantial increase from the current 21%. President Trump would like to lower corporate taxes by 1%. On the personal tax front, Mr. Biden has proposed a suite of personal tax increases, targeting those with incomes greater than $400,000 to address the increased inequality across the population. Capital gains tax increases are also on the table for households with incomes greater than $1 million. Either way, because tax policy is very polarizing, under a divided congress tax policy is expected to remain largely as it is today.

Trade stability would be welcomed

Trade is one area that could have significantly different outcomes, depending on who ultimately becomes the next President. Former Vice President Joe Biden has stated that while he also plans to be tough on China, his approach will be to create a united front with allies to confront China. Investors would welcome a softening of trade rhetoric and tariffs which often create instability and inefficiency, and should help boost global economic growth.

This would be a positive for Canada which has been on the receiving end of tariffs (e.g., the recently threatened tariffs on aluminium) from the Trump administration. Aside from the direct costs, a relief from the threat of further negative actions should be helpful to a host of Canadian sectors.

According to BMO Economics, the estimated combined impact of the imposed and threatened tariffs reduced U.S. and Canadian GDP by about one percent. Given the historical relationship between economic growth and corporate profit growth, the boost in economic growth from “freer trade” would be a positive for Canadian equities.

President Trump is expected to continue to use tariffs to unilaterally exert pressure on trading partners. The President also continues to talk tough on China with a focus on the threat of Chinese technology rivals.

Fiscal stimulus up in the air

No matter who wins the Presidential election, the odds of a major fiscal stimulus package being passed have significantly diminished compared with the “Blue Wave” scenario. In negotiations prior to the election, Senate Republicans were concerned with the size and direction of funds proposed by the Democrats. Under Joe Biden, the fiscal stimulus spending was expected to be significantly larger, with a focus on infrastructure spending. This would boost growth and corporate profits in 2021. Infrastructure spending typically has a multiplier effect on the economy, providing an effective form of economic stimulus. Higher infrastructure spending, in particular, could boost sales for a number of sectors, especially in alternative energy and green technologies, public transportation, and power and communication systems. An increase in the minimum wage could boost aggregate demand, which would be positive for the consumer sectors, but could hurt companies with limited pricing power, such as restaurants and bars that are already struggling to recover from the Coronavirus.

Key sectors

In the case of a Democratic win, the sectors that could be negatively impacted by higher taxes, increased regulation and/or a reduction in federal spending include: Health Care (potential price controls for drugs), Technology (higher taxes, tougher antitrust regime), Financials (higher regulatory burden and taxes), Oil and Gas and Mining (more environmental protection), Defense (lower growth in arms spending), along with industries such as for-profit education and prisons.

Health Care

In the Health Care sector, Biden has been vocal about controlling drug price inflation which would have downward pressure on pharmaceutical and biotech stocks in the short term. However, his track record of pragmatism suggests that, the longer-term impact of a lack of innovation by the pharmaceutical industry due to a decline in research and development investment would not be a price that the party would be willing to pay in exchange for a short-term gain.

We expect that any decline in drug pricing would not deliver the worst-case scenario. Should Biden win, it is more likely that he would focus on the expansion of health care reform (aka “Obamacare”), which has actually been positive for drug sales as more Americans receive insurance coverage. Mr. Biden has also proposed that the federal government play a more active role in a centralized response to the COVID-19 crisis.

In the case of a Trump victory, we would expect the opposite in policy, where he would continue trying to dismantle health care reform. His odds of achieving this aim could also be bolstered by the Republican majority in the Supreme Court.

Energy

The 2020 election campaign showed significant differences in views towards energy policy and climate change. Climate change was central to the Biden campaign, and thus energy companies and auto manufacturers are likely to experience significant change under a Biden Presidency. Biden’s climate agenda was aggressive, with $2 trillion in spending and plans to make environmental policy and climate change a driving force for the U.S. economy.

This is a stark contrast to the Trump administration that has been skeptical about the threat of global warming. Mr. Biden’s target of zero greenhouse-gas emissions by 2035 has long-term implications for auto industry standards, as well as clean energy technology as a replacement for fossil fuels. Renewable energy producers are the clear winners from this election under Biden, with oil and gas producers (already under pressure from weak global demand), the clear losers. If Trump were to win the Presidential race, a potential reversal in outperformance for clean energy technology compared with fossil fuels could ensue. President has already formally withdrawn from the Paris Climate Agreement earlier today.

If history is any guide

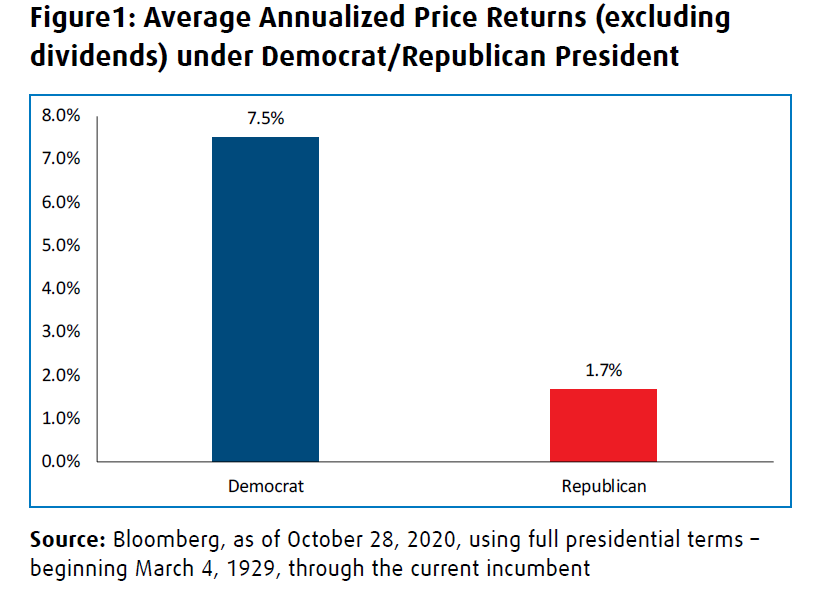

After a strong four-year run in equities under President Trump, the question is, where do we go from here under each potential future leader? Historical market returns can provide perspective. Despite the commonly held view that Republican leadership is more stock market friendly, market performance has been superior under a Democrat

President since 1929. Specifically, under Democratic leadership, the S&P 500 has achieved average annualized returns of 7.5% versus 1.7% when a Republican was President.

Outlook for interest rates

For interest rates and, in turn, bond markets, the election result does not change the U.S. Federal Reserve’s (“the Fed”) explicit commitment to maintain its policy rate at zero for the foreseeable future. The risk now for investors is higher long-term interest rates, a trend recently observed in the weeks leading up to the election as markets anticipated a “Blue Wave.”

Instead the Treasury bond market is awakening to uncertainty which is supportive for interest rates, at least temporarily. The narrative however doesn’t change as to what the future holds; the potential for aggressive fiscal stimulus is a clear positive for an economy expected to face multiple headwinds. The combination of fiscal stimulus, significant bond supply and the economic recovery, should gradually lead long-term interest rates to resume their uptrend.

In estimating how far rates can travel, it is difficult to say without knowing who will hold office. It would also be too early to count the Fed out of the equation. It is debatable at this stage whether the Fed would accept higher rates in the current precarious economic environment. If needed, the Fed could still adjust the pace and/or extend the term of its purchases under the Quantitative Easing (“QE”) program to pressure long-term interest rates downward. The Fed could also enact a policy where short-term debt is swapped for longer-term debt, commonly referred to as “Operation Twist.” Regardless of the Fed’s current policy targets, higher interest rates represent the path of least resistance.

Concluding thoughts

The U.S. Presidential election captivated our attention for much of the past year and January 20, 2021 will mark the commencement of the new four-year term of the next President of the United States. The two parties are more ideologically divided than at any point over the past twenty years. Although we remain under a cloud of uncertainty about who will ultimately be the next President of the United States, one thing is certain: Whoever wins the White House, battling COVID-19 will be the next President’s most formidable challenge.

Please speak with your BMO financial professional if you have any questions or would like to discuss your investment portfolio.

General Disclosure

The information and opinions in this report were prepared by BMO Nesbitt Burns Inc. Portfolio Advisory Team (“BMO Nesbitt Burns”). This publication is protected by copyright laws. Views or opinions expressed herein may differ from the views and opinions expressed by BMO Capital Markets’ Research Department. No part of this publication or its contents may be copied, downloaded, stored in a retrieval system, further transmitted, or otherwise reproduced, stored, disseminated, transferred or used, in any form or by any means by any third parties, except with the prior written permission of BMO Nesbitt Burns. Any further disclosure or use, distribution, dissemination or copying of this publication, message or any attachment is strictly prohibited. If you have received this report in error, please notify the sender immediately and delete or destroy this report without reading, copying or forwarding. The opinions, estimates and projections contained in this report are those of BMO Nesbitt Burns as of the date of this report and are subject to change without notice. BMO Nesbitt Burns endeavours to ensure that the contents have been compiled or derived from sources that we believe are reliable and contain information and opinions that are accurate and complete. However, BMO Nesbitt Burns makes no representation or warranty, express or implied, in respect thereof, takes no responsibility for any errors and omissions contained herein and accepts no liability whatsoever for any loss arising from any use of, or reliance on, this report or its contents. Information may be available to BMO Nesbitt Burns or its affiliates that is not reflected in this report. This report is not to be construed as an offer to sell or solicitation of an offer to buy or sell any security. BMO Nesbitt Burns or its affiliates will buy from or sell to customers the securities of issuers mentioned in this report on a principal basis. BMO Nesbitt Burns, its affiliates, officers, directors or employees may have a long or short position in the securities discussed herein, related securities or in options, futures or other derivative instruments based thereon. BMO Nesbitt Burns or its affiliates may act as financial advisor and/or underwriter for the issuers mentioned herein and may receive remuneration for same. Bank of Montreal or its affiliates (“BMO”) has lending arrangements with, or provides other remunerated services to, many issuers covered by BMO Nesbitt Burns’ Portfolio Advisory Team. A significant lending relationship may exist between BMO and certain of the issuers mentioned herein. BMO Nesbitt Burns Inc. is a wholly owned subsidiary of Bank of Montreal. Dissemination of Reports: BMO Nesbitt Burns Portfolio Advisory Team’s reports are made widely available at the same time to all BMO Nesbitt Burns investment advisors. Additional Matters TO U.S. RESIDENTS: Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Capital Markets Corp. (“BMO CM”) and/or BMO Nesbitt Burns Securities Ltd. (“BMO NBSL”) TO U.K. RESIDENTS: The contents hereof are intended solely for the use of, and may only be issued or passed onto, persons described in part VI of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001. BMO Wealth Management is the brand name for a business group consisting of Bank of Montreal and certain of its affiliates, including BMO Nesbitt Burns Inc., in providing wealth management products and services.

BMO Nesbitt Burns Inc is a Member-Canadian Investor Protection Fund and a Member of the Investment Industry Regulatory Organization of Canada..

BMO CM and BMO NBSL are Members of SIPC. ® BMO and the roundel symbol are registered trade-marks of Bank of Montreal, used under license. ® “Nesbitt Burns” is a registered trade-mark of BMO Nesbitt Burns Inc. If you are already a client of BMO Nesbitt Burns, please contact your investment Advisor for more information.